In a very dynamic market after few years of exceptional peaks and suprising lows, we enjoyed a relatively calm start of 2024 with prices slowly returning to a level of normality, but how long can this last?

Goodbye best buy, hello daily volatility. Adam Harding, Head of Procurement

The challenge: complex data parsing across multiple formats

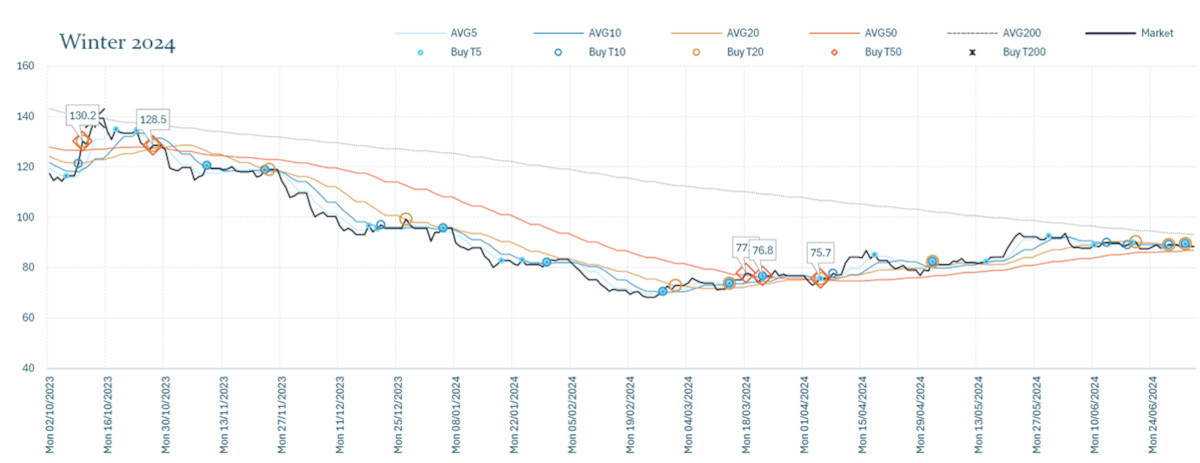

Winter-24: As the season`s dated maturity looms ever present, we reflect on whether the best opportunity to buy has already passed, or whether nearside bargains present an opening to make savy purchases.

In June the UK national grid ESO gave us an early glimpse as to the winter season`s outlook. We are assured that there is sufficient operational surplus to meet base demand even with wind and outage considerations. We have improvements in gasification, interconnectivity, storage levels, and French nuclear power plants to thank. Businesses will however understand that incidents in the months leading up to the season will ultimately set the price they`ll pay despite national grid`s assurances on operational concerns. We explore these impacts and what purchasing opportunities there were over the past year.

Our system generated alerts, created forty end-of-day crossover triggers. Crossover events occur when short-term trends go through longer-termed averages, suggesting a change in the trend`s direction. Taking the strongest pricing confluences we review the fundamentals at the crossover points and winter prices available at that time.

- £130.20 £128.50

Following Hamas led attack on Israel on the 7 October and Israel`s retaliation we experienced upward ticks in the energy markets. Traders paused to examine its impact on oil and Liquid Natural Gas (LNG) prices on cargoes coming through the red sea and whether war would spill over into other parts of the region.

The attack followed the largest switching period between UK suppliers at the beginning of the month of October and many buyers may have hoped for some relief in energy prices during the month.

In addition to the Israel-Hamas war, prices gathered upward momentum as a result of:

• industrial action at Australian LNG facilities

• colder weather forecast and weaker wind speeds

• unplanned maintenance at Oseberg field

- £76.80 £75.70

Aided by the warmest winter on record, EU storage facilities remained largely intact (dipping to 62% full at the end of February) leading to energy prices sliding to a 30 month low in February of £68/MWh.

The lag in trend crossover was picked up through directional changes prior to the Easter and the final trading days on the summer season contract. The upward trend remind us of our increased dependency on LNG and its impact on marginal prices as well as the effect of the gas squeeze from Russia.

Commentators reference speculative and algorithmic trading towards the end of the period, which was also flagged by our system triggers. Events at this time included:

• unplanned outages at Aasta Hansteen; Nyhamna gas plant and Gullfaks gas field

• Prolonged maintenance at US Freeport LNG terminal from January due to an electrical fault

• International bidding to attract LNG shipments with the JKM benchmark at a premium over TTF

• An unexpected drop in temperatures heralded the arrival of Storm Kathleen which in turn increase wind generation thereby easing reliance on gas fired generation.

• Russian attacks on Ukrainian underground storages, and drone attacks on Zaporizhzhia nuclear power plant

• Germany shut 15 coal-fired power plants.

- £89.50

Energy market instability increasingly becomes a predominant feature in the months leading up to the start of the season. Even with healthy storage levels recorded across the European Union,

gas sourced from Russia made up 11% of all EU imports in the first half of the year. Tensions in the Middle East are being closely monitored as markets react to Israeli authorities

announcing the assassination of the top Hezbollah commander from a strike in Beirut, in retaliation to Saturday's Golan Heights rocket attack. Later Hamas leader Ismail Haniyeh was assassinated

in Tehran adding to the worsening Israeli conflict in Gaza and Lebanon. Iran`s response to the assassination will provide a steer on whether the war will escalate within the region weighing on supply risks.

• Bullish technical trading on European carbon contributed to gains on gas.

• Heat wave across Europe draw in increased demand

• A run of low LNG send out sparked concerns for competition for demand as China`s LNG demand increased

• Heavy summer maintenance programme impact UK domestic production

Elsewhere, weakening demand signals from the US and China on the manufacturing sector pressures oil prices to decline on the month.